portability estate tax return

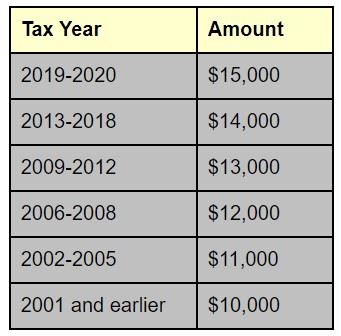

An automatic six month extension of time to file the return is available to all estates including those filing solely to elect portability by filing Form 4768 on or before the due date of. The effect of portability is that a married couple has a combined 234 million exemption from the federal estate and gift tax and a combined 10 million exemption from the Maryland estate tax for 2021.

A New Era In Death And Estate Taxes

Another concept needs to be understood as well portability.

. To secure these benefits however the deceased spouses. Calculating the DSUE is simple. No further action is required to elect portability.

It is transferred to the surviving spouse to reduce the overall estate tax once the second spouse passes away. The IRS thankfully has made electing portability easy. Thanks to portability the surviving spouse can use the deceased spouses unused estate tax exemption and add it to their own when the surviving spouse passes away.

The temporary portability regulations require every estate electing portability to file an estate tax return within nine 9 months of the decedents date of death unless an extension of time for. Depending on the size of the estate you may wish to take advantage of estate tax portability which allows a spouse to assume the tax exemption of their deceased spouse on top of their own. This portability election increases the total exclusion available to the surviving spouse by the amount of the deceased spouses unused exclusion.

Portability occurs when a surviving spouse files an estate tax return for the purpose of calculating and capturing any Estate Tax credit left unused in the estate of the first spouse to die. Estate tax return preparers who prepare a return or claim for refund which reflects. Estate tax return preparers who prepare any return or claim for refund which reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such return.

A Bit of Background. This transfer is accomplished by completing the election on the Form 706 Estate Tax Return and can be completed without regard to the legal ownership of each spouse. This term refers to the ability to transfer that unused portion to the surviving spouse referred to as the deceased spouses unused exemption DSUE.

Portability Election on Form 706 The estate of a decedent with a surviving spouse elects portability of the DSUEA by completing and timely filing Form 706. In other words for DSUE portability to be claimed the executor must elect portability on the deceased spouses estate tax return. Opting Out The estate of a decedent with a surviving spouse which files Form.

Portability allows a surviving spouse to apply a deceased spouses unused federal gift and estate tax exemption amount toward his or her own transfers during life or at death. NO REQUIREMENT TO FILE FORM 706 OTHER THAN TO ELECT PORTABILITY TOTAL TAXABLE ESTATE IS UNDER THE BASIC EXCLUSION AMOUNT OF 5490 MILLION The portability election must be filed on a Form 706 by the the date a normal federal estate tax return must be filed 9 months after the date of death or 15 months with an automatic 6 month. This is called the deceased spouses unused exemption or DSUE.

If the executor timely files the decedents Form 706 United States Estate and Generation-Skipping Transfer Tax Return which generally is due nine months after the. Portability is a federal exemption. Again to elect portability the deceased spouses estate has to file an estate tax return and if that isnt otherwise required that introduces some complexity and some cost into that process.

Portability allows a surviving spouse the ability to transfer the deceased spouses unused exemption amount DSUEA for estate and gifts taxes to a surviving spouse so long as the Portability election is made on a timely filed federal estate tax return IRS Form 706. So this is a discussion you can have with the family to make sure they understand the cost and the potential benefits of portability and they can make the right decision of whether or not to make. The due date of the estate tax return is nine months after the decedents date of death however the.

If you dont file the 706 at the first death you cannot elect to port over this remaining amount. The term election here means a decision made by checking a box on a tax return. Portability is the right of an executor to transfer or port the unused estate tax exemption from the first spouse to die to the second spouse to die.

For 2020 the exemption amount is 1158 million and the IRS just announced that that amount will increase to 117 million for 2021. In order to elect portability of the decedents unused exclusion amount deceased spousal unused exclusion DSUE amount for the benefit of the surviving spouse the estates representative must file an estate tax return Form 706 and the return must be filed timely. Estate tax portability can be a useful tool for couples who are creating estate plans and have a lot of assets between them and is something to be mindful of when youre estate.

Formally this is called the Deceased Spouse Unused Election DSUE. The Impact of the Portability of the Federal Estate Tax Exclusion Example 1. Ad Download Or Email Form IT-R More Fillable Forms Register and Subscribe Now.

In order to elect portability a surviving spouse must file an estate tax return Form 706 for the federal estate tax and Form MET-1 for the Maryland estate tax. What Does Portability of the Estate Tax Exemption Mean. The due date of the estate tax return is nine months after the decedents date of death however the estates representative may request an extension of time to file the return for up to six months.

DSUEA on IRS Form 706 Estate Tax Return Part 6 A. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the. A portability election made by a non-appointed executor when there is no appointed executor for that decedents estate can be superseded by a subsequent contrary election made by an appointed executor of that same decedents estate on an estate tax return filed on or before the due date of the return including extensions actually granted.

A Trust May Be Taxed As Either A Grantor Trust Or A Nongrantor Trust Each Type Of Trust Has Advantages And Disadvanta Estate Tax Estate Planning Grantor Trust

Tackling Tax Issues If You Re An Estate Executor Ferrari Ottoboni Caputo Wunderling Llp

This Is Another In A Series Of Blogs On The Basics Of Estate Planning Estate Planning Attorneys Do Estate Planning Estate Planning Attorney Law Firm Marketing

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Exploring The Estate Tax Part 2 Journal Of Accountancy

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Estate Tax Introduction Video Taxes Khan Academy

Tax Related Estate Planning Lee Kiefer Park

Estate Tax Portability Preserving It For The Benefit Of Your Heirs

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Form 706 Extension For Portability Under Rev Proc 2017 34

Federal Estate Tax Portability The Pollock Firm Llc

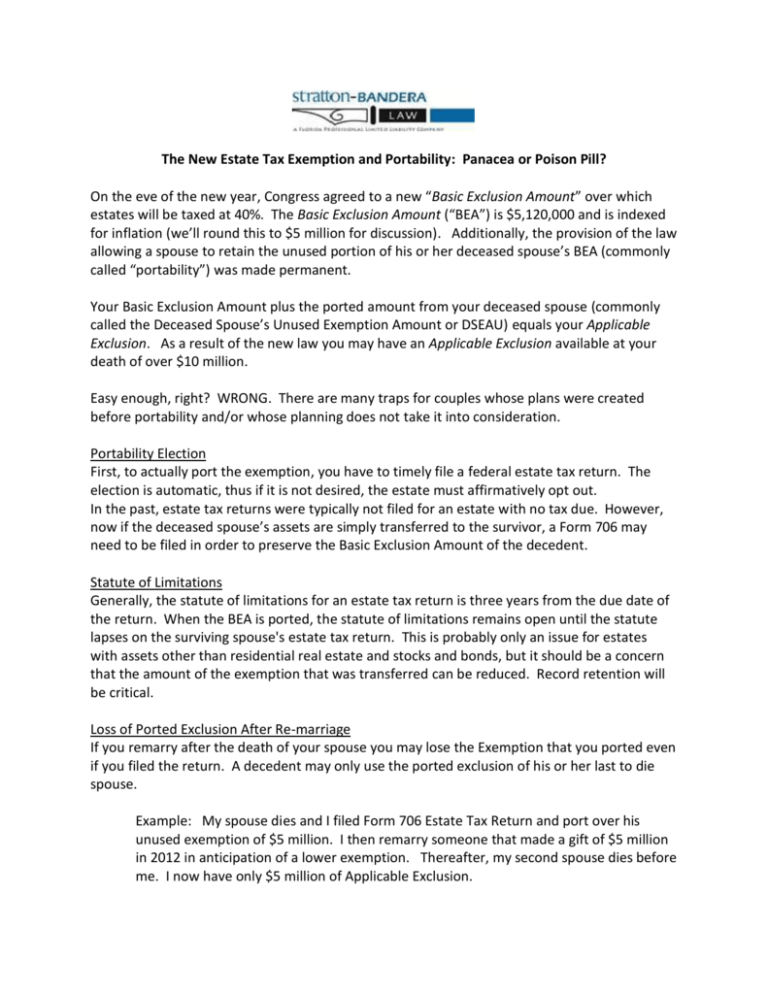

The New Estate Tax Exemption And Portability Panacea Or Poison

Tips For Filing Taxes When Married Rings Married Married Couple

Usattorneys Com What Everyone Should Know About Personal Taxes Payroll Taxes Tax Refund Liberty Tax

Don T Forget About Making A Portability Election Capell Howard P C