oregon workers benefit fund tax rate

Oregon workers are subject to Workers Benefit Fund WBF assessment tax. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

Benefits Oregon Business Industry

Oregon workers benefit fund tax rate Saturday June 18 2022 Edit.

. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. What is the Oregon WBF tax rate. Oregon new market tax credit oregon new market tax credit.

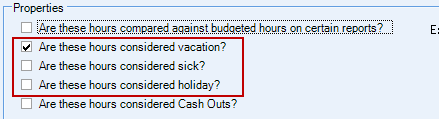

The Workers Benefit Fund WBF assessment this is a payroll assessment calculated on the basis of hours worked by all paid workers. For 2019 our analysts. Color-coded maps of the US.

Prescribe the rate of the Workers Benefit Fund assessment under ORS 656506. This assessment is calculated based on employees per hour worked. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers owners and officers covered by workers compensation.

To protect and serve Oregons consumers and workers while supporting a positive business climate Workers. These coronavirus stimulus checks from Oregon however would go only to low-income workers. If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under.

Employers and employees split this assessment. Oregon Workers Benefit Fund. Employers use Forms OQ and OTC to.

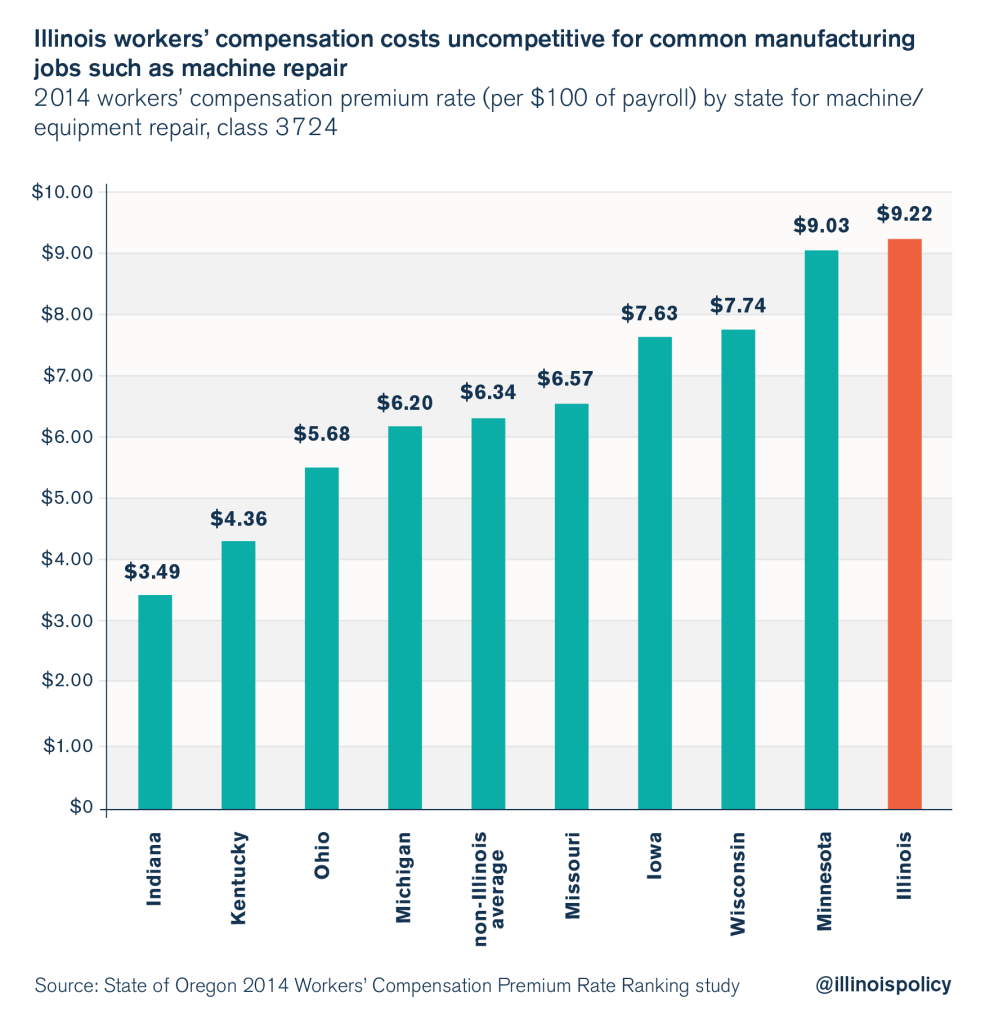

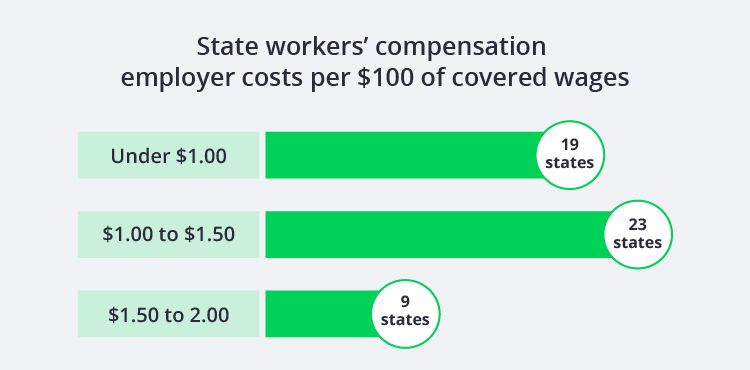

You are responsible for any. Ranking of each states workers. Oregon workers compensation costs already among the lowest in the nation will drop in 2022 for the ninth-straight year.

NE Salem Oregon 97301. You are responsible for any. Oregon Workers Benefit Fund Payroll Tax Overview.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. You are responsible for any. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers.

3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour. Oregon Workers Benefit Fund Payroll Tax Overview. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged.

The Oregon workers compensation payroll assessment rate will not change in 2023. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. For 2022 the rate is 22 cents per hour.

Oregon Workers Benefit Fund Payroll Tax Overview. The Workers Benefit Fund WBFprovides funds for programs that assist employers and injured workers. 653026 Nonurban county defined for ORS.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Wwwdcbsoregongov Testimony of DCBS Director Our Mission. The workers benefit fund assessment rate will be 22 cents per hour in 2023.

Go online at httpswww.

Unemployment Insurance Taxes Options For Program Design And Insolvent Trust Funds Tax Foundation

Department Of Consumer And Business Services Oregon Workers Compensation Costs Oregon Workers Compensation Costs State Of Oregon

Saif Oregon Workers Compensation Insurance And Benefits

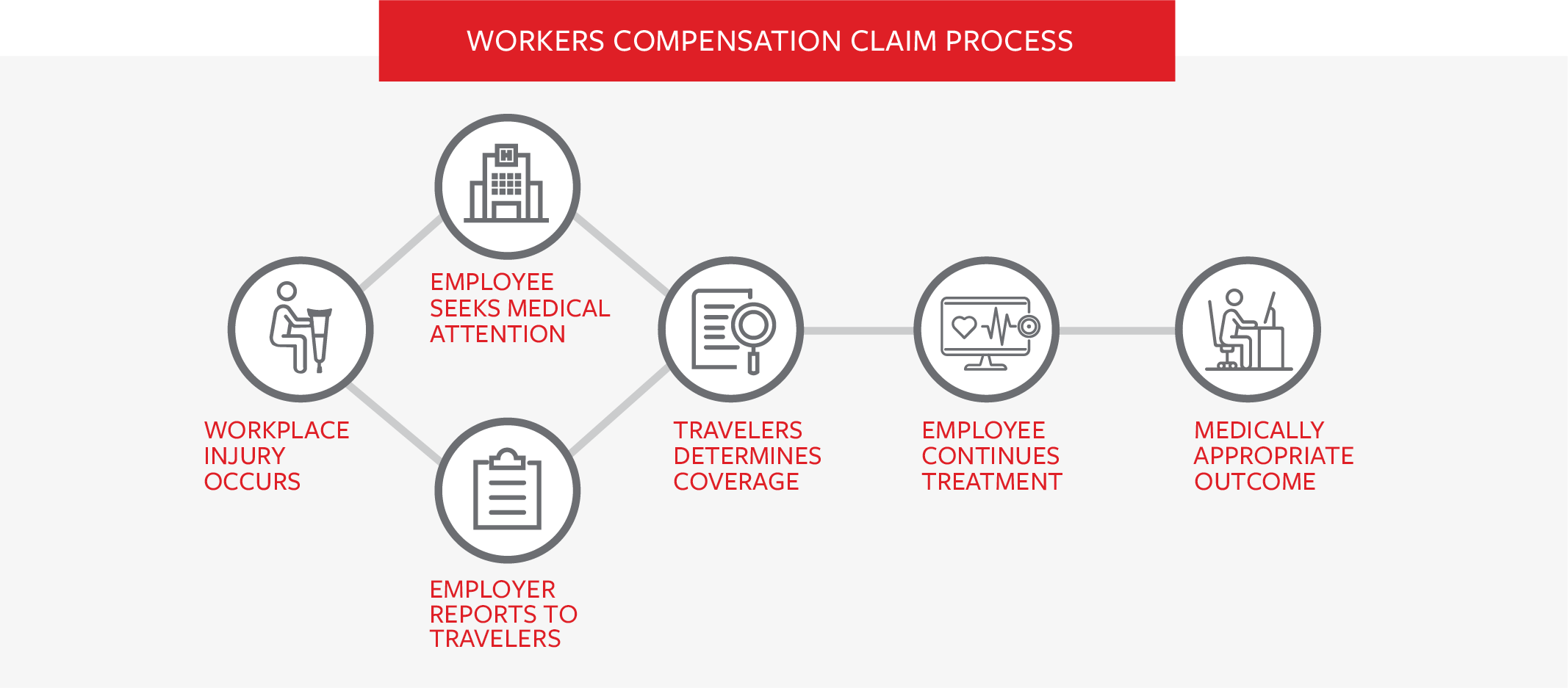

Workers Compensation Resources Travelers Insurance

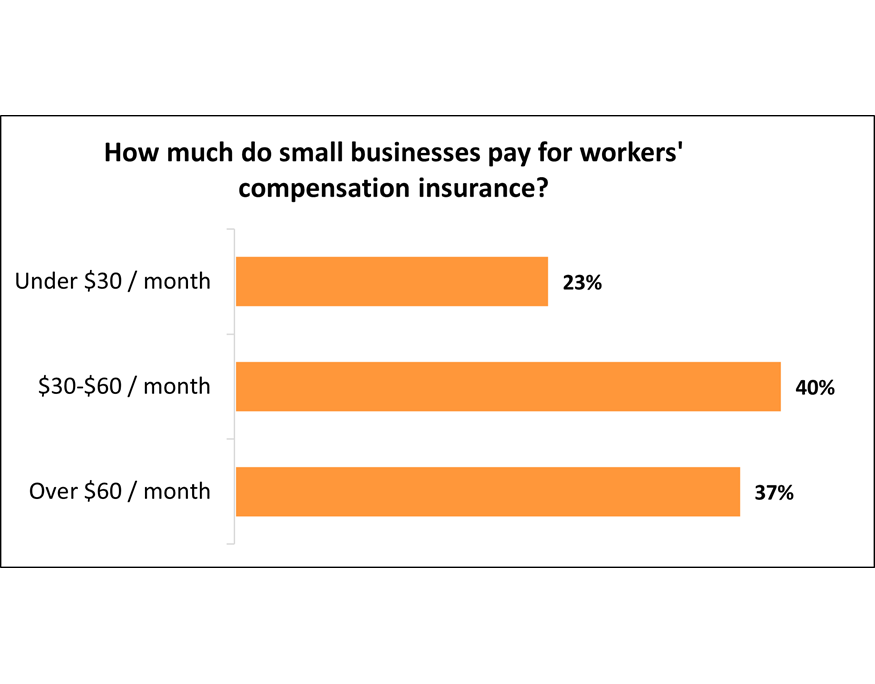

Workers Compensation Insurance Cost Insureon

Calculate Workers Comp Insurance Cost Embroker

Is Workers Comp Taxable Workers Comp Taxes

Oregon Workers Benefit Fund Wbf Assessment

Oregon Household Employment Tax And Labor Law Guide Care Com Homepay

Oregon S New 1 4 Billion Tax What Is Your Business S Share Portland Business Journal

Compare Workers Comp Rates By State Updated In 2022 Insureon

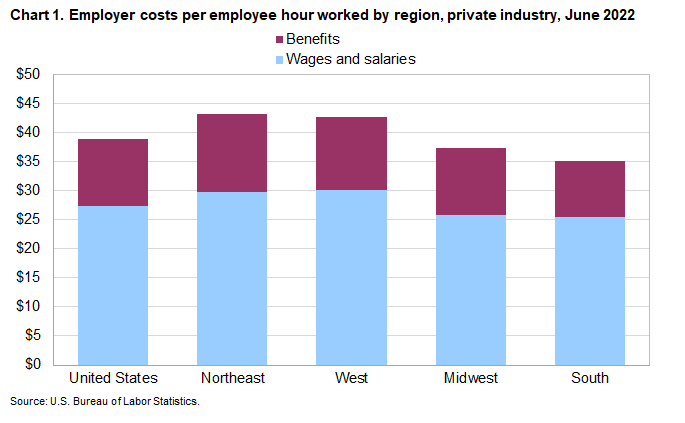

Employer Costs For Employee Compensation For The Regions June 2022 Southwest Information Office U S Bureau Of Labor Statistics

Oregon S Nonresident Workers Article Display Content Qualityinfo

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Workers Comp Settlement Chart Average Payout Expectations

Oregon Workers Benefit Fund Payroll Tax

Oregon Workers Compensation Division Order Compliance Poster Employer State Of Oregon